New Unemployment Benefits 2026: 26 Weeks of Support Eligibility

Anúncios

The new unemployment benefits in 2026 introduce significant changes, including potential eligibility for up to 26 weeks of support, aimed at providing crucial financial stability for American workers experiencing job displacement.

Anúncios

Are you wondering about the future of financial support if you face unexpected job loss? The landscape of unemployment benefits in the United States is evolving, with significant updates slated for 2026. These changes aim to provide a more robust safety net for American workers, potentially offering up to 26 weeks of support. Understanding these new provisions is crucial for anyone who might find themselves in need of assistance.

Understanding the new unemployment benefits framework for 2026

The year 2026 marks a pivotal moment for unemployment assistance in the United States. Driven by economic shifts and lessons learned from past downturns, federal and state governments have collaborated to refine the existing unemployment insurance programs. These reforms are designed to be more responsive to economic realities, ensuring that workers who lose their jobs through no fault of their own receive adequate support.

Anúncios

The primary goal of these new provisions is to offer both immediate financial relief and a stable foundation for re-employment. Historically, unemployment benefits have varied significantly by state, leading to disparities in support. The 2026 framework seeks to introduce a greater degree of standardization while still allowing states some flexibility to address their unique economic conditions. This balance is intended to create a more equitable and effective system nationwide.

Key drivers behind the 2026 reforms

- Economic volatility: Addressing the need for more adaptable support during unexpected economic shifts.

- Technological advancements: Streamlining application and claims processing through digital platforms.

- Workforce evolution: Tailoring benefits to better suit the needs of a changing job market, including gig economy workers.

These reforms are not merely about extending the duration of benefits; they also encompass a broader re-evaluation of how unemployment insurance functions. This includes potential changes to weekly benefit amounts, eligibility thresholds, and the integration of re-employment services. The overall vision is to create a system that is not only a safety net but also a springboard for workers to transition back into the workforce effectively. The changes reflect a commitment to strengthening the economic resilience of individuals and communities across the nation.

Eligibility criteria: who qualifies for the extended support?

Navigating the eligibility requirements for the new unemployment benefits in 2026 is critical for anyone seeking assistance. While the general principles of unemployment insurance remain, the updated framework introduces specific criteria designed to ensure that support reaches those who need it most and are actively seeking re-employment. It’s important to familiarize yourself with these guidelines to determine your potential eligibility for up to 26 weeks of support.

Typically, eligibility hinges on several factors, including your work history, the reason for your job separation, and your availability and willingness to work. The 2026 reforms may refine these aspects, potentially introducing new considerations for specific employment types or economic circumstances. States will still play a significant role in determining precise eligibility, but federal guidelines will set a baseline for these new extended benefits.

General eligibility requirements

- Sufficient earnings and work history: Applicants must have earned a minimum amount of wages during a specific base period.

- Reason for job loss: You must be unemployed through no fault of your own (e.g., layoff, reduction in force).

- Availability and search for work: You must be able and available to work, and actively seeking new employment.

Furthermore, some states may introduce additional requirements, such as participation in re-employment services or training programs, especially for those utilizing the extended benefit duration. These requirements are often designed to facilitate a quicker return to the workforce and enhance job skills. It is advisable to check your specific state’s Department of Labor website for the most accurate and up-to-date eligibility information as 2026 approaches. Understanding these nuances will be key to successfully applying for and receiving the enhanced benefits.

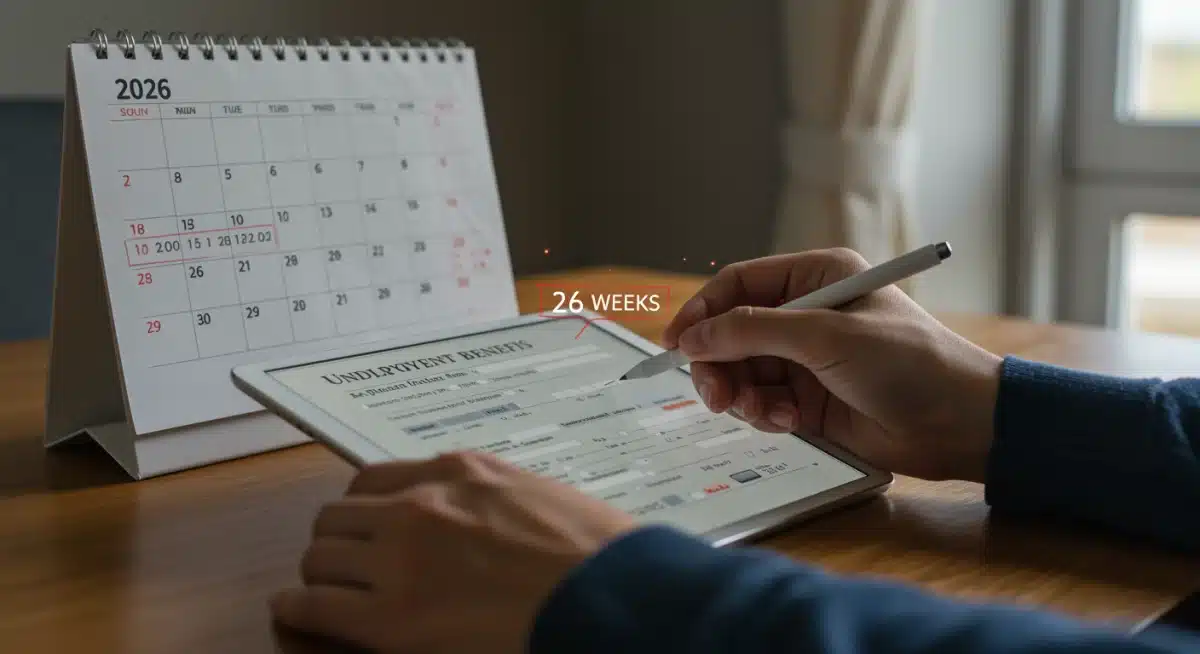

The 26-week duration: what it means for job seekers

The provision of up to 26 weeks of support under the new unemployment benefits in 2026 represents a significant enhancement for job seekers. This extended duration offers a more substantial buffer for individuals and families navigating the challenges of job loss, allowing more time to secure stable employment without immediate financial crisis. It acknowledges that finding suitable work can often take longer than the traditional 13 or 20 weeks offered by some state programs.

For many, this extended period means less pressure to accept the first available job, regardless of its suitability, and more opportunity to pursue roles that align with their skills and career goals. It can also provide the necessary time to undertake retraining or upskilling programs, which are increasingly vital in a rapidly evolving job market. This longer duration can be particularly beneficial during periods of economic uncertainty or for those in industries facing significant restructuring.

Impact of extended benefits on re-employment

- Reduced financial stress: Allows job seekers to focus on quality job searches rather than immediate income.

- Opportunity for skill development: Provides time for training and education to enhance employability.

- Improved job matching: Enables individuals to find roles that are a better fit for their qualifications and aspirations.

While the 26-week duration offers considerable advantages, it also comes with responsibilities. Beneficiaries are typically required to continue actively searching for work and may need to report their job search activities regularly. Some states might also mandate participation in career counseling or workshops to ensure individuals are making the most of their time on benefits. The goal is to balance providing adequate support with encouraging a proactive approach to re-employment, ensuring that the extended period serves as a bridge, not a prolonged dependency.

Application process for 2026 unemployment benefits

The application process for the new unemployment benefits in 2026 is expected to be more streamlined and user-friendly, leveraging digital advancements to simplify what can often be a complex and stressful experience. While specific procedures will vary by state, there will likely be an emphasis on online applications, providing greater accessibility and faster processing times for eligible individuals.

Before initiating an application, it’s crucial to gather all necessary documentation. This typically includes personal identification, employment history, and wage information. Having these details readily available will significantly expedite the application process. Many states are also enhancing their online portals to offer clear instructions, FAQs, and even virtual assistance to guide applicants through each step.

Key steps in the application process

- Gather required documents: Social Security number, driver’s license, employment history, wage statements.

- Access state unemployment agency website: Locate the official online portal for your state’s unemployment benefits.

- Complete the online application: Fill out all sections accurately and thoroughly, providing detailed information.

- Certify for benefits weekly/bi-weekly: Submit regular certifications to confirm continued eligibility and job search efforts.

After submitting your initial application, there will be a waiting period, which varies by state. During this time, your application will be reviewed, and your eligibility determined. It is essential to respond promptly to any requests for additional information from your state’s unemployment agency to avoid delays. Staying informed about the specific requirements and timelines in your state will be paramount to a successful application for the new unemployment benefits in 2026.

State-specific variations and federal oversight

While the new unemployment benefits in 2026 introduce a more unified approach to duration and some eligibility aspects, state-specific variations will continue to play a significant role. The federal government often sets overarching guidelines and provides funding, but individual states retain considerable autonomy in administering their unemployment insurance programs. This means that while the 26-week support period might be a federal recommendation or mandate, the weekly benefit amounts, specific disqualifications, and some procedural details will still be determined at the state level.

This dual system allows states to tailor their programs to local economic conditions and workforce needs, but it also necessitates that applicants understand their state’s particular regulations. For instance, one state might have a higher weekly benefit amount due to a higher cost of living, while another might have more stringent work search requirements. Keeping abreast of these local nuances is crucial for beneficiaries.

Understanding state-level differences

- Weekly benefit amounts: Vary based on state wage calculations and maximum limits.

- Waiting periods: The initial period before benefits begin can differ from state to state.

- Work search requirements: Specific activities and reporting frequencies may be unique to each state.

Federal oversight, however, ensures a baseline level of support and promotes consistency across the nation. This oversight often comes in the form of federal funding, which is contingent upon states adhering to certain standards. The new 2026 framework is expected to refine this balance, encouraging states to align more closely with federal objectives while still preserving their ability to adapt to local circumstances. Therefore, job seekers must consult both federal guidelines and their state’s unemployment agency for comprehensive information.

Maximizing your benefits: tips for job seekers in 2026

Receiving unemployment benefits, especially the new extended support of up to 26 weeks in 2026, is a crucial lifeline during job loss. However, simply receiving benefits isn’t enough; maximizing their impact involves strategic planning and proactive engagement. The goal is not just to collect payments but to leverage this period to successfully transition back into stable employment. This requires understanding the system, fulfilling all obligations, and actively utilizing available resources.

One of the most important aspects of maximizing your benefits is diligent adherence to all reporting requirements. This includes submitting weekly or bi-weekly certifications accurately and on time, and meticulously documenting all job search activities. Any lapse in these duties can lead to delays or even suspension of benefits. Beyond compliance, actively engaging with re-employment services offered by your state can significantly enhance your chances of finding a new job faster.

Strategies for making the most of your unemployment benefits

- Maintain accurate records: Keep detailed logs of job applications, interviews, and communications.

- Engage with career services: Utilize state-provided resources like resume workshops, job fairs, and counseling.

- Consider retraining or upskilling: Explore educational opportunities that can enhance your marketability.

Furthermore, managing your finances wisely during this period is paramount. Create a budget, prioritize essential expenses, and explore any additional support programs you might be eligible for. The 26 weeks of support are designed to provide a financial cushion, but careful management ensures it lasts. By being proactive and informed, job seekers can transform a challenging period of unemployment into an opportunity for growth and successful re-entry into the workforce.

| Key Aspect | Brief Description |

|---|---|

| Benefit Duration | Up to 26 weeks of financial support for eligible workers. |

| Eligibility | Requires sufficient work history, involuntary job loss, and active job search. |

| Application | Primarily online through state unemployment agencies; requires documentation. |

| State Variations | Weekly benefit amounts and specific rules vary by state despite federal guidelines. |

Frequently asked questions about 2026 unemployment benefits

The primary change for 2026 unemployment benefits is the potential for an extended duration of support, offering up to 26 weeks. Additionally, there’s an increased focus on streamlined digital application processes and a more standardized federal framework, while still allowing for state-specific adjustments to weekly benefit amounts and certain eligibility criteria.

Eligibility typically depends on your work history, the reason for job separation (must be involuntary), and your availability to work and active job search. You should consult your state’s Department of Labor or unemployment agency website as 2026 approaches for the most current and specific requirements tailored to your location.

While the duration of benefits may be extended, weekly benefit amounts are largely determined by individual states based on your past earnings. There might be federal incentives or guidelines encouraging states to review their maximum benefit limits, but specific increases will vary by state and economic conditions.

You will generally need your Social Security number, a valid government-issued ID (like a driver’s license), detailed employment history for the past 18 months, and wage information (e.g., W-2s or pay stubs). Having these ready will significantly speed up your application process.

The 2026 reforms are expected to address the evolving workforce, potentially making it easier for gig workers and independent contractors to access unemployment benefits. Eligibility will likely depend on state-specific rules and whether you’ve contributed to unemployment insurance funds, either directly or through special programs.

Conclusion

The upcoming changes to unemployment benefits in 2026 represent a proactive effort to strengthen the safety net for American workers. With the potential for up to 26 weeks of support, alongside streamlined application processes and a balance of federal oversight and state flexibility, the system aims to be more responsive and effective. For anyone facing job loss, understanding these new provisions, diligently navigating the application process, and actively engaging with re-employment resources will be paramount to securing financial stability and successfully transitioning back into the workforce. Stay informed through official state and federal channels to make the most of these enhanced benefits.