Hidden Tax Deductions for U.S. Homeowners in 2026

Anúncios

Unlocking Hidden Value: 5 Lesser-Known Tax Deductions for U.S. Homeowners in 2026 That Save Over $1,000 Annually can significantly reduce your tax burden, offering substantial financial relief often overlooked by many.

Anúncios

Are you a U.S. homeowner looking for ways to reduce your tax liability in 2026? Beyond the well-known mortgage interest and property tax deductions, there’s a treasure trove of lesser-known tax benefits waiting to be discovered. By understanding and utilizing these often-overlooked deductions, you could potentially save over $1,000 annually, putting more money back into your pocket. Let’s delve into these valuable opportunities.

Understanding the Tax Landscape for Homeowners in 2026

The U.S. tax code is complex, constantly evolving, and often filled with nuances that can greatly benefit informed homeowners. While many are aware of standard deductions for mortgage interest and real estate taxes, these only scratch the surface of potential savings. In 2026, several provisions continue to offer homeowners unique opportunities to reduce their taxable income, provided they know where to look and how to qualify.

Anúncios

Navigating these regulations requires a proactive approach and a keen eye for detail. Many homeowners miss out on legitimate deductions simply because they are unaware of their existence or the specific criteria for claiming them. This section will lay the groundwork for understanding the broader context of homeowner tax benefits, setting the stage for our exploration of five specific, often-ignored deductions.

The Evolving Nature of Tax Benefits

Tax laws are not static; they are influenced by economic conditions, legislative priorities, and societal needs. What was deductible last year might have different limits or requirements this year. Staying informed is crucial for maximizing your tax advantages. For example, credits for energy-efficient home improvements have seen various iterations over the years, reflecting a national push towards sustainability.

- Annual review of IRS publications is recommended.

- Consulting a qualified tax professional can uncover personalized opportunities.

- Keeping meticulous records throughout the year simplifies the filing process.

By staying abreast of these changes, homeowners can strategically plan their finances and home-related expenditures to best leverage available tax incentives. This proactive stance ensures that no stone is left unturned in the pursuit of tax efficiency.

Ultimately, a comprehensive understanding of the tax landscape is the first step towards unlocking the hidden value within your home ownership. It’s about more than just filling out forms; it’s about intelligent financial planning that utilizes every tool at your disposal.

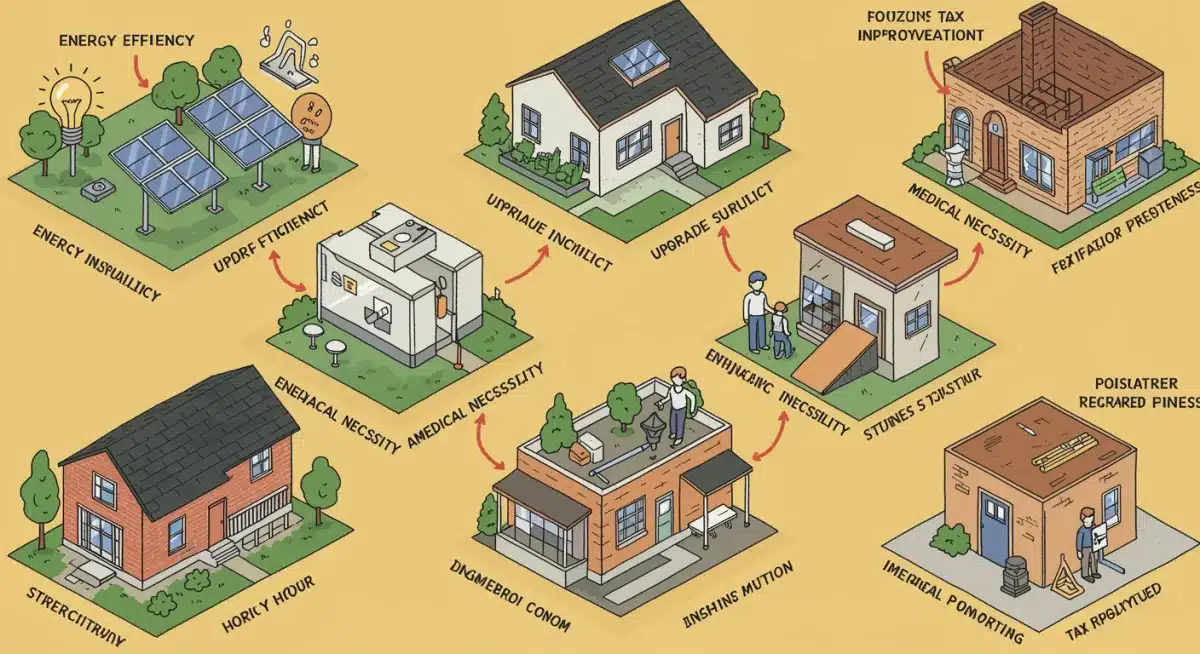

1. Energy-Efficient Home Improvement Credits

One of the most impactful, yet frequently underutilized, tax benefits for homeowners in 2026 revolves around energy-efficient home improvements. The federal government continues to encourage homeowners to invest in upgrades that reduce energy consumption, offering significant tax credits as an incentive. These aren’t just deductions; they are credits that directly reduce your tax bill, dollar for dollar.

Many homeowners undertake projects like installing new windows, upgrading insulation, or replacing old HVAC systems without realizing the substantial tax relief these improvements can bring. Understanding the specific qualifications and eligible expenses is key to claiming these valuable credits.

Qualifying for the Energy-Efficient Home Improvement Credit

To qualify for these credits, the improvements must meet specific energy efficiency standards set by the IRS. This often involves ensuring that products like windows, doors, and certain types of insulation meet ENERGY STAR requirements. For HVAC systems, specific efficiency ratings are usually mandated.

- Eligible improvements include certain types of insulation, exterior windows, and specific energy-efficient heating and cooling equipment.

- The credit covers a percentage of the cost of eligible improvements, up to a certain annual limit.

- Always retain receipts and manufacturer certifications to substantiate your claims.

The beauty of these credits is that they not only save you money on your taxes but also lead to lower utility bills in the long run. It’s a double win for homeowners looking to enhance their property’s value and efficiency.

Ensuring that your chosen products and installations meet the necessary federal guidelines is paramount. A little research upfront can prevent issues during tax season and ensure you fully benefit from these generous credits.

2. Medical Home Improvements and Accessibility Upgrades

For homeowners facing medical challenges or those caring for individuals with special needs, certain home modifications can qualify for significant tax deductions. These aren’t just about making a home comfortable; they are about making it accessible and safe, and the IRS recognizes the financial burden these necessary changes can impose. This category of deduction is often overlooked because it falls under medical expenses, which have a high adjusted gross income (AGI) threshold.

However, if your total medical expenses, including these home modifications, exceed 7.5% of your AGI, the amount above that threshold can be deductible. This can be a substantial saving for eligible households.

What Qualifies as a Medical Home Improvement?

Eligible improvements must be primarily for medical care and not primarily for increasing the home’s value. Examples include installing ramps, widening doorways, modifying bathrooms for accessibility, or even lowering cabinets. If the improvement adds to the home’s value, only the amount exceeding the increase in value can be deducted. However, many modifications for medical purposes do not significantly increase resale value.

- Ramps, grab bars, and wheelchair-accessible modifications are common examples.

- Elevators installed for medical necessity may also qualify.

- A doctor’s recommendation can strengthen your claim.

It’s crucial to differentiate between improvements that are purely for medical purposes and those that are considered capital expenses for luxury or general enhancement. Keeping detailed records of medical necessity and costs is vital for these deductions.

These deductions provide a much-needed financial break for families adapting their homes to meet critical health and accessibility requirements, making an otherwise costly endeavor more manageable.

3. Home Office Deduction for the Self-Employed

While the home office deduction became more widely discussed during the recent shift to remote work, many self-employed individuals still fail to fully leverage its potential. For 2026, if you are self-employed and use a portion of your home exclusively and regularly for business, you may be eligible to deduct expenses related to that space. This deduction can significantly reduce your taxable income, especially for small business owners and freelancers.

The key here is the ‘exclusive and regular use’ rule. A spare bedroom occasionally used for work won’t qualify, but a dedicated office space will. This deduction covers a portion of your home expenses, such as utilities, insurance, depreciation, and repairs.

Simplified vs. Regular Method

The IRS offers two methods for claiming the home office deduction. The simplified option allows you to deduct a standard amount per square foot of your home office, up to a maximum square footage. This method is easier to calculate and requires less record-keeping.

The regular method, on the other hand, involves calculating the actual expenses attributable to your home office. While more complex, it can sometimes result in a larger deduction, especially if your actual expenses are high. This requires meticulous record-keeping of all home expenses and calculating the percentage of your home used for business.

- The simplified method offers ease of calculation.

- The regular method can yield higher deductions but demands detailed records.

- Maintaining a separate space exclusively for business is non-negotiable for eligibility.

Choosing the right method depends on your specific situation and the extent of your home office expenses. For many, the simplified method provides a straightforward way to claim a valuable deduction without the burden of extensive paperwork.

For self-employed homeowners, this deduction is a powerful tool to offset business income and reduce overall tax liability, directly linking your home to your professional financial strategy.

4. Private Mortgage Insurance (PMI) Deductions

Private Mortgage Insurance (PMI) is a common expense for homeowners who make a down payment of less than 20% on their home. While it protects the lender, it can feel like an extra burden for borrowers. What many don’t realize is that for 2026, PMI premiums can still be deductible as mortgage interest, subject to certain income limitations. This deduction has been a on-again, off-again benefit, making it easy for homeowners to lose track of its current status.

It’s crucial to check if this provision is active for the 2026 tax year, as its inclusion can hinge on legislative decisions. Assuming it is, it represents a significant, often overlooked, deduction for many first-time homebuyers or those who refinanced with less equity.

Income Limitations and Eligibility

The ability to deduct PMI is typically phased out for higher-income taxpayers. This means that if your adjusted gross income (AGI) exceeds a certain threshold, the amount you can deduct for PMI premiums will begin to decrease, eventually disappearing entirely.

- The deduction applies to PMI premiums paid on mortgages taken out after 2006.

- Income limitations are a key factor in determining eligibility and the deductible amount.

- Your lender will typically report the amount of PMI paid on Form 1098, along with your mortgage interest.

Even if you are subject to income limitations, any portion of the PMI deduction can still provide a valuable reduction in your taxable income. It’s an expense that homeowners have to pay, so claiming it as a deduction helps mitigate some of that financial outlay.

Always verify the current tax law for the specific year you are filing, as the PMI deduction has a history of legislative uncertainty. If available, it’s a deduction that can easily save hundreds of dollars.

5. Deduction for Points Paid on a Refinanced Mortgage

When you purchase a home, any points paid to obtain your mortgage are generally deductible in the year you pay them. However, when you refinance a mortgage, the rules change, and this is where many homeowners miss a valuable opportunity. For a refinanced mortgage, points must typically be deducted over the life of the loan, rather than all at once. This often leads to homeowners overlooking this deduction entirely.

While deducting points over the life of a 30-year loan might seem like a small annual amount, these deductions add up over time and should not be ignored. It’s a consistent, albeit smaller, tax break that contributes to your overall savings.

Calculating and Claiming Refinance Points

To deduct points paid on a refinanced mortgage, you’ll need to amortize them over the loan’s term. For example, if you paid $3,000 in points on a 30-year (360-month) loan, you could deduct $10 per month. If you refinanced in July, you could deduct $60 for that tax year. This continuous deduction can provide ongoing tax relief.

- Points are generally amortized over the life of the new loan.

- If you sell or refinance again, any unamortized points can usually be deducted in full in that year.

- Your loan documents will clearly state any points paid at closing.

Keeping track of these amortized deductions year after year might seem tedious, but the cumulative savings can be substantial. It’s a long-term benefit that rewards diligent record-keeping.

Don’t let the complexity deter you; spreading out the deduction for points on a refinanced mortgage is a legitimate way to reduce your taxable income annually, contributing to your overall financial well-being as a homeowner.

| Deduction Category | Brief Description |

|---|---|

| Energy-Efficient Credits | Tax credits for qualifying home improvements that reduce energy consumption, directly lowering your tax bill. |

| Medical Home Improvements | Deductions for home modifications made for medical care or accessibility, subject to AGI thresholds. |

| Home Office Deduction | For self-employed individuals using a portion of their home exclusively for business, covering related expenses. |

| PMI & Refinance Points | Deductions for Private Mortgage Insurance premiums and amortized points paid on refinanced mortgages. |

Frequently Asked Questions About Homeowner Tax Deductions

To qualify, ensure your improvements meet specific ENERGY STAR or federal efficiency standards. Always keep manufacturer certifications, detailed receipts, and documentation proving the energy efficiency of the products installed. Consulting with a tax professional before undertaking major projects is also advisable.

No, only improvements primarily for medical care or to accommodate special needs are deductible. If an improvement increases your home’s value, only the amount exceeding that increase is deductible. It is essential to have a doctor’s recommendation and detailed records of expenses and medical necessity.

This rule means the space must be used solely for your business activities and on an ongoing basis. An area occasionally used for work, or a room with mixed personal and business use, generally won’t qualify. It must be a dedicated workspace.

The deduction for Private Mortgage Insurance (PMI) is subject to Adjusted Gross Income (AGI) limitations. If your AGI exceeds a certain threshold, the deductible amount will be phased out. It’s crucial to check the specific income limits for the 2026 tax year.

Unlike points on a purchase mortgage, points on a refinanced mortgage must be amortized, meaning you deduct a portion of them each year over the life of the loan. Keep your closing documents to calculate the annual deductible amount. If you sell or refinance again, any remaining points can be deducted.

Conclusion

Unlocking Hidden Value: 5 Lesser-Known Tax Deductions for U.S. Homeowners in 2026 That Save Over $1,000 Annually is not just a catchy phrase; it’s a tangible goal for diligent homeowners. By moving beyond the most common deductions and exploring opportunities like energy-efficient credits, medical home improvements, the home office deduction, PMI premiums, and amortized refinance points, you can significantly reduce your tax burden. The key is meticulous record-keeping, staying informed about evolving tax laws, and not shying away from seeking professional tax advice. These often-overlooked benefits are designed to reward homeowners who make smart financial and property management decisions, ultimately putting more of your hard-earned money back where it belongs: in your pocket.