Annuities 2026: Retirement Income & 8% Guaranteed Returns Explained

Anúncios

Annuities in 2026 serve as a vital component in retirement income planning, offering a secure and predictable income stream, often with attractive guaranteed returns, to ensure financial stability throughout one’s golden years.

Anúncios

As we navigate the complexities of long-term financial security, understanding how annuities in 2026 retirement income planning can secure your future becomes paramount. With the promise of stable income and potentially attractive guaranteed returns, annuities are emerging as a cornerstone for those seeking peace of mind in their golden years.

The evolving landscape of retirement income in 2026

The financial world is in constant flux, and 2026 presents a unique set of challenges and opportunities for retirement planning. Traditional pensions are increasingly rare, placing a greater emphasis on individual savings and strategic investments to fund post-career life.

Anúncios

Against this backdrop, annuities are gaining renewed attention. They offer a contractual agreement with an insurance company, providing regular payments, either immediately or at a future date, often for the remainder of your life. This predictability is a significant draw in an unpredictable market.

Economic factors influencing annuity appeal

Several economic indicators in 2026 are making annuities particularly attractive. Interest rates, inflation, and market volatility all play a role in shaping their value proposition. Higher interest rates, for instance, can lead to more favorable annuity payouts.

- Inflation concerns: While inflation can erode purchasing power, some annuities offer inflation protection.

- Market volatility: The stability of annuities contrasts sharply with unpredictable stock market fluctuations.

- Longevity risk: Annuities provide income for life, mitigating the risk of outliving savings.

Understanding these underlying economic currents is crucial for appreciating why annuities are a compelling option for retirement income in the current financial climate. They offer a hedge against some of the most pressing financial risks retirees face.

What are annuities? A fundamental overview for 2026

At their core, annuities are financial products designed to provide a steady stream of income, primarily during retirement. You pay a lump sum or a series of payments to an insurance company, and in return, they promise to pay you back over time, often for life. This fundamental concept remains consistent in 2026, but the specific features and benefits have evolved.

The appeal lies in their ability to convert a portion of your savings into guaranteed income, removing the burden of managing investments and worrying about market downturns. They serve as a vital component of a diversified retirement portfolio, balancing growth-oriented assets with income-generating ones.

Key characteristics of modern annuities

Modern annuities come with various features tailored to different financial goals. Understanding these characteristics is essential for making an informed decision about their role in your retirement strategy.

- Income guarantees: Many annuities offer guaranteed income for life, regardless of market performance.

- Tax deferral: Earnings within an annuity grow tax-deferred until withdrawal.

- Death benefits: Some annuities include provisions for beneficiaries upon the annuitant’s death.

- Customizable options: Riders and additional features allow for personalization of annuity contracts.

These characteristics highlight the flexibility and security that annuities can offer. They are not one-size-fits-all products, and their adaptability is a major strength in complex financial planning.

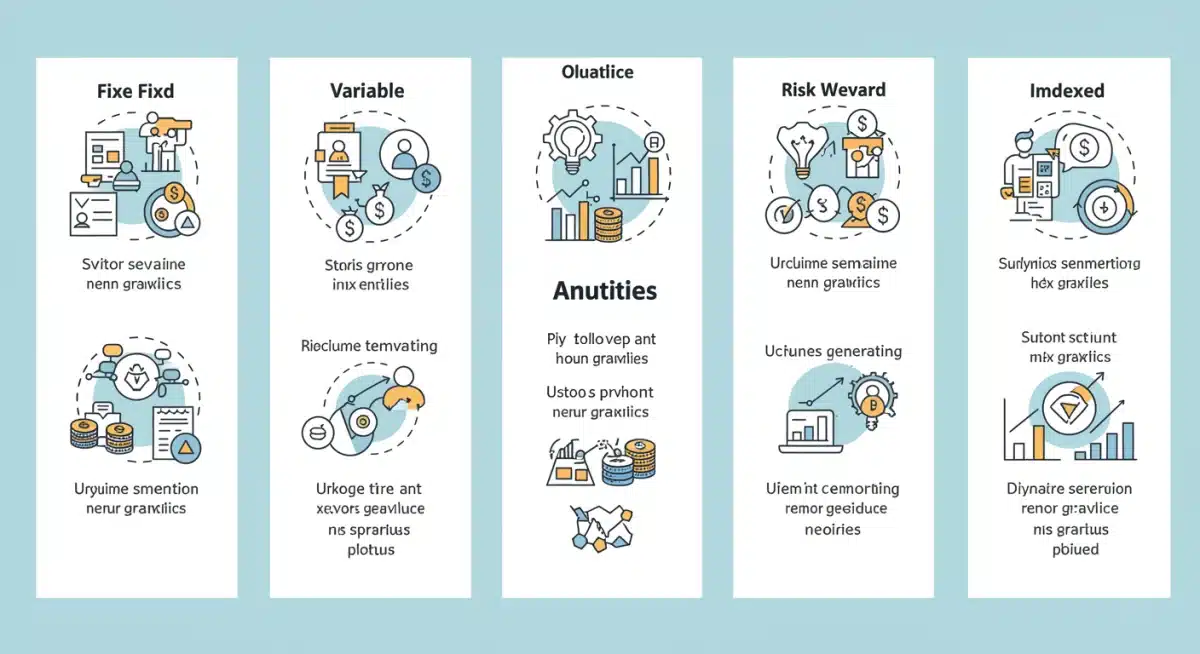

Exploring the types of annuities available in 2026

The annuity market in 2026 offers a diverse array of products, each designed with specific goals and risk tolerances in mind. Categorizing them helps in understanding which might best suit your individual retirement income needs.

From the simplicity of fixed annuities to the growth potential of variable annuities, and the hybrid nature of indexed annuities, there’s a spectrum of choices. Each type carries its own set of advantages and disadvantages, making a detailed comparison essential.

Fixed annuities: stability and predictability

Fixed annuities are perhaps the most straightforward. They offer a guaranteed interest rate for a set period, providing predictable growth and income streams. In a volatile market, their stability can be a significant comfort.

These are often favored by those who prioritize capital preservation and a guaranteed return over potential higher growth. The interest rate is declared upfront, allowing for clear financial forecasting.

Variable annuities: growth potential with market risk

Variable annuities allow your money to be invested in a selection of sub-accounts, similar to mutual funds. Their value, and thus your income, can fluctuate with market performance, offering growth potential but also carrying investment risk.

They are suitable for individuals comfortable with market exposure who are seeking higher returns. Many variable annuities also offer optional riders for guaranteed income or death benefits, adding a layer of protection.

Fixed indexed annuities: balancing growth and protection

Fixed indexed annuities (FIAs) offer a unique blend of features. They provide growth potential tied to a market index (like the S&P 500) without direct exposure to market losses. Your principal is protected from market downturns, while participation in market gains is capped.

FIAs appeal to those who want more growth than a fixed annuity but less risk than a variable annuity. The crediting methods can be complex, so understanding the caps, participation rates, and spread fees is crucial.

The choice among these types depends heavily on your individual financial situation, risk tolerance, and retirement goals. Each offers a distinct path toward securing your retirement income.

The promise of 8% guaranteed returns in 2026: reality or myth?

The prospect of an 8% guaranteed return on an annuity in 2026 is certainly enticing, but it’s important to approach such claims with a clear understanding of what they entail. While some annuities may indeed offer guaranteed income streams that effectively translate to an 8% annual return on the income base, this often comes with specific conditions and nuances.

It’s crucial to differentiate between an actual growth rate on your principal and an income rider’s growth rate, which is used solely for calculating future income payments and not for cash surrender value. These distinctions are critical for managing expectations and making informed decisions.

Understanding income riders and their guarantees

Many annuities offering high guaranteed rates do so through optional income riders. These riders guarantee a specific growth rate on an ‘income base’ that is separate from your contract’s cash value. This income base is then used to calculate your future lifetime withdrawals.

- Income base vs. cash value: The guaranteed growth applies to the income base, not necessarily the amount you can withdraw as a lump sum.

- Withdrawal percentages: The 8% might refer to the growth of the income base, which is then multiplied by a withdrawal percentage (e.g., 5%) to determine your annual income.

- Fees: Income riders typically come with additional fees, which can impact the overall return on your investment.

While an 8% guaranteed income base growth sounds impressive, it’s essential to read the fine print. Such guarantees are designed to provide a higher income stream in retirement, but they don’t necessarily mean your initial investment is growing at that rate for all purposes.

Comparing annuities with other retirement income strategies

While annuities offer compelling benefits, especially with their guaranteed income features, it’s vital to compare them against other popular retirement income strategies in 2026. A diversified approach often yields the most secure and robust retirement plan.

Understanding how annuities stack up against 401(k)s, IRAs, and other investment vehicles helps in positioning them correctly within your overall financial portfolio. Each strategy has its strengths and weaknesses, catering to different aspects of retirement funding.

Annuities vs. 401(k)s and IRAs

401(k)s and IRAs are primary savings vehicles, allowing for tax-advantaged growth of your investments. They offer flexibility in investment choices and withdrawal strategies, but they don’t typically offer guaranteed lifetime income.

- Growth potential: 401(k)s and IRAs can offer higher growth potential but come with market risk.

- Income certainty: Annuities provide guaranteed income, whereas 401(k)s and IRAs require careful management to ensure income longevity.

- Tax treatment: Both offer tax advantages, but annuity withdrawals are taxed differently than traditional IRA/401(k) withdrawals.

Annuities can complement these accounts by converting a portion of accumulated savings into a predictable income stream, thereby de-risking the income portion of your retirement plan.

Other income sources: social security and pensions

Social Security remains a foundational component of retirement income for many. Pensions, though less common, also provide guaranteed income. Annuities can bridge the gap between these foundational sources and your desired lifestyle.

Unlike Social Security, which is subject to government policy changes, or pensions, which are employer-dependent, annuities offer a private contractual guarantee, adding another layer of security to your financial future.

Choosing the right annuity for your 2026 retirement plan

Selecting the appropriate annuity requires careful consideration of your personal financial situation, risk tolerance, and retirement goals. There’s no one-size-fits-all answer, and what works for one individual may not be suitable for another.

It involves a thorough assessment of your current assets, projected expenses, desired lifestyle in retirement, and how long you expect your retirement to last. This holistic view ensures that an annuity, if chosen, truly serves your best interests.

Factors to consider before purchasing

Before committing to an annuity, several key factors should influence your decision-making process. These considerations will help you identify the type of annuity that aligns with your specific needs.

- Your age and health: These can impact payout rates and the suitability of certain annuity types.

- Income needs: How much guaranteed income do you need to cover essential expenses?

- Risk tolerance: Are you comfortable with market fluctuations, or do you prefer guaranteed stability?

- Liquidity needs: Annuities can be illiquid; ensure you have access to other funds for emergencies.

- Inflation protection: Consider annuities with riders that protect against the rising cost of living.

Consulting with a qualified financial advisor is highly recommended. They can help you navigate the complexities of annuity contracts, compare different products, and ensure the annuity fits seamlessly into your broader financial plan.

Advanced strategies and future trends for annuities in 2026

The annuity market is constantly evolving, and 2026 is seeing the emergence of advanced strategies and innovative products designed to meet more nuanced retirement planning needs. Staying informed about these trends can help optimize your annuity decisions.

These advancements often involve greater personalization, enhanced liquidity options, and more sophisticated ways to manage risk and provide income. The goal is to make annuities even more adaptable to individual circumstances.

Longevity annuities and qualified longevity annuity contracts (QLACs)

Longevity annuities, including QLACs, are designed to provide income far into the future, typically starting at age 80 or 85. They address the fear of outliving one’s savings, especially as lifespans continue to increase.

QLACs have specific IRS rules that allow a portion of your IRA or 401(k) to be used to purchase them, deferring taxes on that amount until income payments begin. This can be a powerful tool for tax-efficient income planning in later retirement.

Hybrid annuities and integrated solutions

The trend in 2026 is towards more hybrid products that combine features of different annuity types or integrate annuities with other financial tools. These aim to offer the best of multiple worlds, such as market participation with principal protection, or long-term care benefits with guaranteed income.

These integrated solutions require a deeper understanding but can provide comprehensive coverage for various retirement risks. They represent the industry’s response to the demand for more flexible and robust retirement income solutions.

Keeping abreast of these developments will be crucial for anyone looking to leverage annuities effectively for their 2026 retirement income planning. The industry is continuously innovating to offer better solutions for retirees.

| Key Aspect | Brief Description |

|---|---|

| Guaranteed Income | Annuities provide a predictable, often lifelong, income stream in retirement. |

| Types of Annuities | Fixed, Variable, and Fixed Indexed annuities cater to different risk profiles. |

| 8% Guaranteed Returns | Often refers to income base growth for future withdrawals, not cash value. |

| Financial Planning | Integrate annuities with 401(k)s, IRAs, and Social Security for comprehensive security. |

Frequently asked questions about annuities in 2026

The main benefit is guaranteed income for life, which provides financial security and peace of mind, mitigating the risk of outliving your savings. This predictability is highly valued in current economic conditions.

An 8% guarantee often applies to an income base, not your cash value. This base grows to determine future income payments, usually through an optional rider that may incur additional fees. It’s crucial to understand these specifics.

No, annuities are not universally suitable. They are best for individuals seeking guaranteed income and are willing to trade some liquidity for that security. Your age, financial goals, and risk tolerance are key factors.

In 2026, the main types include fixed annuities for stability, variable annuities for market-linked growth, and fixed indexed annuities that offer principal protection with market participation.

Absolutely. Given the complexity and long-term commitment of annuities, consulting a qualified financial advisor is essential. They can help assess your needs and determine if an annuity aligns with your overall financial strategy.

Conclusion

As we’ve explored, understanding annuities in 2026 retirement income planning is more crucial than ever. With their capacity to provide guaranteed income, protect against market volatility, and potentially offer attractive returns, annuities stand as a powerful tool in the modern retiree’s arsenal. While the allure of 8% guaranteed returns requires careful scrutiny to understand its true implications for income versus cash value, the fundamental promise of income security remains a cornerstone of their appeal. By carefully considering the various types of annuities, comparing them with other retirement strategies, and seeking expert advice, individuals can effectively integrate annuities into a robust and personalized retirement plan, ensuring financial stability and peace of mind for years to come.