Smart Investing 2026: Undervalued U.S. Stocks with 25% Growth

Anúncios

Smart investing in 2026 involves identifying undervalued U.S. stocks poised for at least 25% growth within 12 months, requiring careful analysis of market dynamics, company fundamentals, and emerging economic trends.

Anúncios

Welcome to a pivotal year for investors. In 2026, the landscape for finding truly undervalued U.S. stocks with a promising 12-month growth potential of 25% or more requires a sharp eye and a strategic approach. This guide will help you navigate the complexities and pinpoint opportunities that others might overlook.

Anúncios

Understanding the 2026 Market Landscape for U.S. Stocks

The year 2026 presents a unique economic environment, shaped by technological advancements, evolving consumer behaviors, and geopolitical shifts. Understanding these overarching forces is crucial before diving into specific stock selections. Inflationary pressures, interest rate policies, and supply chain optimizations continue to influence market valuations across various sectors.

Investors must move beyond traditional metrics and adopt a forward-looking perspective. The U.S. market, while resilient, is constantly recalibrating, creating both challenges and significant opportunities for those who can accurately predict future trends and identify mispriced assets. This requires a deep dive into macroeconomic indicators and sector-specific catalysts.

Technological Disruption and Innovation

Technological innovation remains a primary driver of market growth. Sectors like artificial intelligence, biotechnology, sustainable energy, and advanced manufacturing are experiencing rapid evolution. Companies at the forefront of these innovations often possess a competitive edge that can lead to substantial long-term value creation.

- Artificial Intelligence (AI): Continued expansion into new industries, enhancing productivity and creating new market segments.

- Biotechnology: Breakthroughs in gene editing, personalized medicine, and disease prevention redefine healthcare.

- Sustainable Energy: Increased investment and adoption of renewable energy sources, driving demand for related technologies and infrastructure.

- Advanced Manufacturing: Automation, robotics, and 3D printing transforming production processes and supply chains.

Identifying companies that are not just adopting but also pioneering these technologies is key. Their current valuations might not fully reflect their future potential, making them prime candidates for an undervalued assessment.

Economic Headwinds and Tailwinds

While innovation drives growth, economic factors can create volatility. Global trade relations, domestic fiscal policies, and consumer spending patterns all play a role. A nuanced understanding of these elements helps in gauging overall market sentiment and identifying sectors that might be unfairly punished or overlooked.

For instance, a temporary economic slowdown might depress stock prices across the board, even for fundamentally strong companies. This creates a window of opportunity for investors to acquire quality assets at a discount. Conversely, sectors benefiting from favorable government policies or robust consumer demand could offer consistent growth, though finding truly undervalued plays might be harder in these areas.

In summary, navigating the 2026 market requires a blend of macro-economic awareness and micro-level analysis. The interplay of technological innovation and economic forces will define which sectors and companies offer the most compelling opportunities for significant growth.

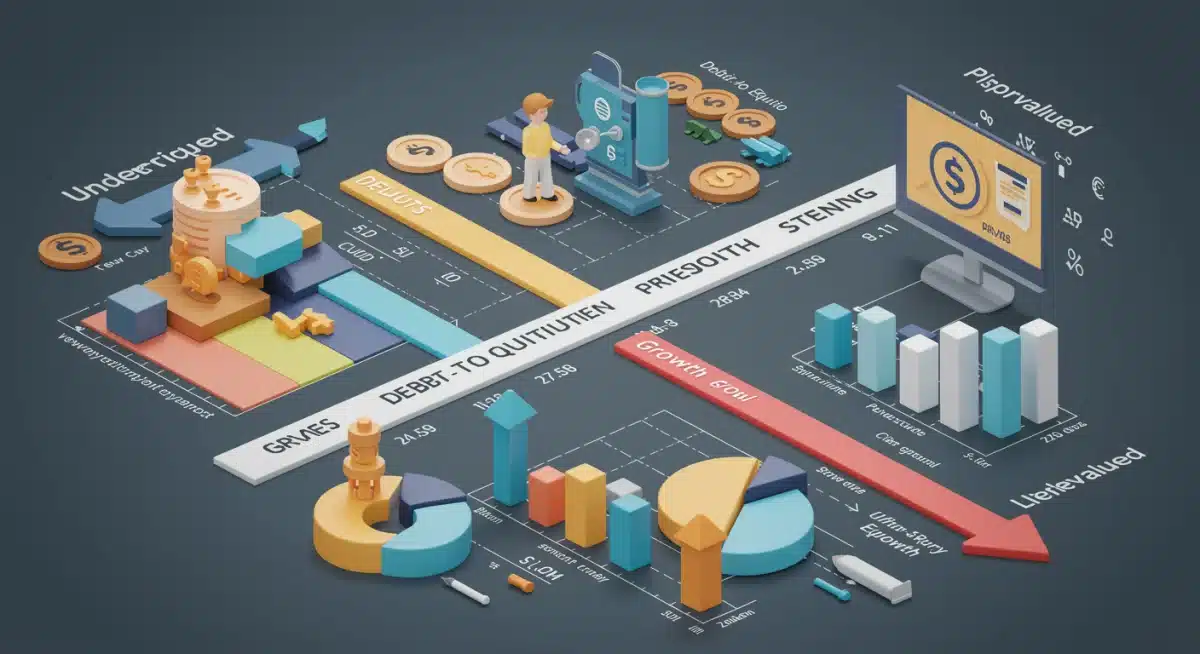

Defining Undervalued: Beyond Simple Ratios

Defining an undervalued stock goes far beyond merely looking at a low price-to-earnings (P/E) ratio. While traditional valuation metrics provide a starting point, a comprehensive assessment requires a deeper dive into a company’s intrinsic value, competitive advantages, and future growth prospects. In 2026, market efficiency means truly undervalued gems are often hidden in plain sight, requiring diligent research.

An undervalued stock is one whose current market price is significantly lower than its intrinsic value. This discrepancy can arise from various factors, including temporary market overreactions, negative news unrelated to core business fundamentals, or simply a lack of investor awareness regarding a company’s long-term potential.

Key Valuation Metrics to Consider

While not the sole determinants, several financial metrics are essential in the initial screening process. These help to flag potential candidates that warrant further investigation.

- Price-to-Earnings (P/E) Ratio: Compares a company’s share price to its earnings per share. A lower P/E relative to its industry peers or historical average can indicate undervaluation.

- Price-to-Book (P/B) Ratio: Measures the market price per share against the book value per share. A low P/B ratio suggests the stock might be trading below its asset value.

- Debt-to-Equity Ratio: Indicates a company’s reliance on debt financing. While not a direct valuation metric, excessive debt can signal financial instability, making a stock riskier even if it appears undervalued.

- Free Cash Flow (FCF) Yield: Calculated as FCF per share divided by share price. A high FCF yield indicates a company generates ample cash relative to its market capitalization, which is a strong sign of financial health and potential for shareholder returns.

It is important to compare these metrics against industry averages and the company’s historical performance. A low P/E in a high-growth industry might be more significant than a similar P/E in a stagnant sector.

Qualitative Factors for Intrinsic Value

Beyond the numbers, qualitative factors often hold the key to unlocking true intrinsic value. These elements are harder to quantify but are critical for sustainable growth and competitive advantage.

Consider the strength of a company’s management team, its brand reputation, intellectual property, and its competitive moat. A strong brand, for instance, can command premium pricing and customer loyalty, providing a significant advantage that isn’t always reflected in quarterly earnings. Similarly, patents and proprietary technology can secure future revenue streams.

In conclusion, identifying an undervalued U.S. stock requires a blend of quantitative analysis and qualitative judgment. It’s about recognizing when the market has mispriced an asset, offering an opportunity for substantial returns once its true value is recognized.

Sector-Specific Opportunities for 25% Growth

To achieve a 25% growth potential in 12 months, investors must pinpoint sectors poised for significant expansion and identify companies within those sectors that possess strong fundamentals and catalysts for revaluation. In 2026, several U.S. sectors stand out due to their alignment with mega-trends and potential for robust earnings growth.

Focusing on sectors that are undergoing structural changes, benefiting from increased demand, or experiencing rapid innovation can significantly enhance the probability of finding high-growth opportunities. It’s not just about strong industries, but about strong companies within those industries that are currently overlooked.

The Rise of Sustainable Technologies

The push for sustainability continues to accelerate, driven by both consumer demand and regulatory incentives. Companies in renewable energy, electric vehicle infrastructure, and eco-friendly manufacturing are experiencing unprecedented growth. However, not all companies in this space are created equal, and some may be trading below their true potential.

- Renewable Energy: Solar, wind, geothermal, and energy storage solutions are expanding rapidly. Look for innovators in battery technology or grid modernization.

- Electric Vehicles (EV) & Infrastructure: Beyond EV manufacturers, consider companies involved in charging networks, specialized components, and raw material extraction for batteries.

- Circular Economy: Businesses focused on recycling, waste reduction, and sustainable materials are gaining traction as resource scarcity becomes a greater concern.

These sectors often require substantial capital investment, but those with strong balance sheets and proven technological advantages are poised for significant market share gains and profitability.

Healthcare Innovation and Digital Health

The healthcare sector remains a defensive play with significant growth potential, particularly in areas driven by technological innovation and aging demographics. Digital health, personalized medicine, and advanced diagnostics are transforming patient care and creating new market opportunities.

Companies developing cutting-edge treatments, diagnostic tools, or platforms that improve healthcare delivery efficiency are likely to see substantial growth. The regulatory environment can be complex, but successful navigation often leads to strong competitive moats.

In essence, identifying undervalued opportunities within these high-growth sectors requires a keen understanding of both the industry dynamics and the specific competitive advantages of individual companies. The goal is to uncover businesses where market perception lags behind their genuine growth trajectory.

Due Diligence: Researching Potential Undervalued Stocks

Once potential undervalued stocks are identified, thorough due diligence becomes paramount. This involves a deep dive into financial statements, management quality, competitive landscape, and future growth catalysts. Skipping this critical step can lead to significant investment errors, even if the initial screening appears promising.

Effective due diligence moves beyond surface-level information, seeking to understand the underlying business model, its resilience, and its capacity for sustained profitability. It’s about building a conviction based on solid evidence, not just speculation.

Analyzing Financial Statements and Reports

The 10-K and 10-Q reports filed with the SEC are invaluable resources. These documents provide a detailed look at a company’s financial health, operational performance, and risk factors. Pay close attention to trends in revenue growth, profit margins, cash flow from operations, and debt levels.

- Income Statement: Look for consistent revenue growth, improving gross and net profit margins, and sustainable operating expenses.

- Balance Sheet: Assess liquidity (current ratio, quick ratio) and solvency (debt-to-equity). A strong balance sheet indicates resilience during economic downturns.

- Cash Flow Statement: Focus on cash flow from operations, which indicates the company’s ability to generate cash from its core business. Positive and growing FCF is a strong indicator of health.

It’s also crucial to analyze management discussion and analysis (MD&A) sections for insights into the company’s strategy, challenges, and future outlook. Discrepancies between management’s narrative and financial performance should raise red flags.

Assessing Management and Competitive Moat

The quality of a company’s management team often dictates its long-term success. Look for experienced leaders with a clear vision, a track record of effective capital allocation, and transparent communication with shareholders. Scrutinize executive compensation relative to performance.

A competitive moat refers to a company’s sustainable competitive advantage that protects its long-term profits and market share from competing firms. This can include:

- Brand Identity: Strong, recognizable brands that command customer loyalty.

- Network Effects: Products or services that become more valuable as more people use them (e.g., social media platforms).

- Cost Advantages: Companies that can produce goods or services at a lower cost than competitors.

- Patents and Intellectual Property: Exclusive rights to technologies or processes.

Understanding these qualitative aspects is vital. A company with a strong moat can often weather economic storms and continue to grow, even if its current valuation doesn’t fully reflect this strength.

In conclusion, thorough due diligence is the bedrock of smart investing. It transforms a speculative idea into a well-reasoned investment decision, significantly increasing the chances of achieving that 25% growth target.

Catalysts for Revaluation and Growth Acceleration

Identifying an undervalued U.S. stock is only half the battle; understanding what will trigger its revaluation and accelerate its growth is equally important. Catalysts are specific events or developments that can change market perception and drive a stock’s price upwards, often leading to rapid appreciation within a 12-month timeframe.

These catalysts can be internal to the company, industry-specific, or broader macroeconomic shifts. Astute investors look for companies with multiple potential catalysts, increasing the likelihood of a positive revaluation.

Company-Specific Catalysts

Internal developments within a company can often be strong drivers of stock price appreciation. These are often within management’s control and can be anticipated through careful monitoring of company announcements and industry news.

- New Product Launches: Successful introduction of innovative products or services that open new markets or significantly enhance existing offerings.

- Strategic Acquisitions: Well-executed mergers or acquisitions that create synergies, expand market share, or provide access to new technologies.

- Cost-Cutting Initiatives: Programs that improve operational efficiency and boost profit margins.

- Patent Approvals or Regulatory Clearances: Especially critical in sectors like biotech and pharmaceuticals, where regulatory hurdles can be significant.

- Leadership Changes: The appointment of a new, highly respected CEO or executive team can signal a fresh strategic direction and instill investor confidence.

These events can fundamentally alter a company’s earnings potential and competitive position, making its current valuation appear increasingly attractive.

Industry and Macroeconomic Catalysts

Broader industry trends and macroeconomic shifts can also act as powerful catalysts, lifting entire sectors and the undervalued stocks within them. These are often less predictable but can have a more widespread impact.

For example, a sudden increase in government spending on infrastructure could boost construction and materials companies. Similarly, a breakthrough in renewable energy technology could benefit all players in that ecosystem. A shift in consumer preference towards healthier food options could elevate specific food producers or alternative protein companies.

Moreover, a general improvement in economic sentiment, lower interest rates, or increased foreign investment can create a tailwind for the entire market, allowing fundamentally strong but overlooked companies to finally gain recognition. Tracking economic indicators and sector-specific news flow is essential for identifying these broader catalysts.

In essence, identifying catalysts is about understanding the narrative shift that will bring an undervalued stock into the market’s favor. It’s the ‘why now?’ behind your investment thesis, crucial for realizing that 25% growth potential within a year.

Risk Management and Portfolio Diversification in 2026

Even with the most meticulous research, investing in undervalued stocks with high growth potential carries inherent risks. Effective risk management and strategic portfolio diversification are not just best practices; they are essential for protecting capital and ensuring long-term success, especially when targeting ambitious returns like 25% in 12 months.

A well-diversified portfolio mitigates the impact of underperforming individual stocks or sector-specific downturns. It ensures that your overall investment strategy remains robust against unforeseen market fluctuations and company-specific challenges.

Understanding and Mitigating Investment Risks

Every investment comes with risks, and growth-oriented undervalued stocks are no exception. These can include market risk, company-specific risk, liquidity risk, and even regulatory risk. Acknowledging these potential pitfalls is the first step towards managing them.

Consider conducting stress tests on your investment thesis: What if the product launch is delayed? What if a competitor introduces a superior technology? How would an economic recession impact this company’s earnings? Having contingency plans and understanding the downside scenarios is crucial.

One key mitigation strategy is to maintain a margin of safety. This involves buying stocks at a price significantly below your calculated intrinsic value, providing a buffer against unexpected negative events or errors in judgment. The larger the margin of safety, the lower your risk exposure.

The Importance of Diversification

Diversification is the cornerstone of prudent risk management. It involves spreading your investments across different asset classes, industries, geographic regions, and company sizes. For investors focused on undervalued U.S. stocks, this means not putting all your capital into a single high-potential stock or even a single sector.

- Sector Diversification: Invest across multiple industries (e.g., technology, healthcare, financials, consumer staples) to avoid overexposure to any single sector’s downturn.

- Company Size Diversification: Balance investments between large-cap, mid-cap, and small-cap companies, as they tend to react differently to market conditions.

- Geographic Diversification: While the focus here is U.S. stocks, consider having some allocation to international markets as well, to reduce country-specific risks.

- Strategy Diversification: Combine undervalued growth stocks with other investment strategies, such as dividend-paying stocks or value investments, to create a more balanced risk-return profile.

Diversification doesn’t eliminate risk entirely, but it significantly reduces portfolio volatility and the impact of any single investment’s poor performance. It’s about building a resilient portfolio that can withstand market turbulence and continue to generate returns.

Ultimately, smart investing in 2026 is not just about finding the next big winner; it’s about building a robust investment framework that incorporates thorough research, realistic expectations, and disciplined risk management to achieve your financial goals.

Monitoring and Adjusting Your Investment Strategy

Investing in undervalued U.S. stocks with a 25% growth potential is not a set-it-and-forget-it strategy. The market is dynamic, and company fundamentals can change rapidly. Continuous monitoring and a willingness to adjust your investment thesis are crucial for capitalizing on opportunities and minimizing losses. Your initial analysis provides a roadmap, but market realities often demand course corrections.

Regularly reviewing your portfolio and the companies within it ensures that your investment decisions remain aligned with your financial objectives and the evolving market landscape. This proactive approach distinguishes successful investors from those who merely hope for the best.

Establishing Monitoring Protocols

Develop a systematic approach to monitoring your investments. This should include tracking key financial metrics, staying updated on company news, and observing broader industry trends. Set specific alerts for significant events that could impact your holdings.

- Quarterly Earnings Reports: Analyze performance against expectations, management guidance, and changes in financial health.

- News and Analyst Coverage: Stay informed about major company announcements, competitive developments, and shifts in analyst sentiment.

- Industry Trends: Monitor technological advancements, regulatory changes, and consumer behavior shifts that could affect your invested sectors.

- Valuation Reassessment: Periodically re-evaluate the intrinsic value of your holdings based on new information and market conditions.

It is important to differentiate between short-term market noise and fundamental changes. Don’t overreact to daily price fluctuations, but pay close attention to developments that could permanently alter a company’s long-term prospects.

Knowing When to Adjust Your Thesis

An investment thesis is a hypothesis, and like any hypothesis, it must be tested and, if necessary, revised. Be prepared to acknowledge when your initial assumptions about a company’s undervaluation or growth potential are no longer valid. This requires intellectual honesty and discipline.

Signs that your thesis might need adjustment include:

- Significant deterioration in financial performance that is not temporary.

- Loss of competitive advantage due to new entrants or disruptive technologies.

- Changes in management that undermine confidence in the company’s future direction.

- Regulatory changes that negatively impact the business model.

- The stock reaching its fair value or becoming overvalued, signaling an opportune time to take profits.

Adjusting your strategy might mean selling a stock, reducing your position, or even increasing it if new information strengthens your conviction. The goal is always to optimize your portfolio for future returns, not to cling to past decisions out of stubbornness.

Ultimately, successful investing in 2026 for 25% growth hinges on a continuous cycle of research, investment, monitoring, and adjustment. This adaptive approach ensures your portfolio remains dynamic and responsive to an ever-changing market.

| Key Investment Area | Brief Description |

|---|---|

| Market Landscape 2026 | Focus on AI, biotech, sustainable energy, and advanced manufacturing as key growth drivers. |

| Defining Undervalued | Beyond P/E, assess intrinsic value, competitive moats, and future growth prospects. |

| Due Diligence | Thorough analysis of financial statements, management, and competitive advantages. |

| Catalysts & Risk Management | Identify triggers for revaluation and diversify to mitigate inherent investment risks. |

Frequently Asked Questions About Smart Investing in 2026

Investors in 2026 face challenges such as persistent inflation, evolving interest rate policies, geopolitical tensions, and rapid technological disruption. Navigating these factors requires a flexible and well-informed investment strategy to identify genuine growth opportunities amidst market volatility.

Identifying truly undervalued U.S. stocks involves looking beyond traditional P/E ratios. Focus on intrinsic value, strong balance sheets, competitive moats, and robust free cash flow. Compare metrics against industry peers and historical performance to spot discrepancies between market price and fundamental worth.

Sectors such as sustainable technologies (renewable energy, EV infrastructure), advanced AI and computing, and innovative biotechnology are projected to offer significant growth potential in 2026. Focus on companies within these sectors that demonstrate strong innovation and market adoption.

Catalysts are specific events or developments that can trigger a positive shift in market perception and drive a stock’s price higher. These can include new product launches, strategic acquisitions, favorable regulatory approvals, or significant cost-cutting initiatives, all accelerating growth and revaluation.

Diversification is crucial because it spreads risk across various assets, industries, and company sizes. This mitigates the impact of any single underperforming stock or sector downturn, protecting your capital and enhancing the resilience of your portfolio against unpredictable market events.

Conclusion

Smart investing in 2026: Identifying undervalued U.S. stocks with 12-month growth potential of 25% is an endeavor that demands both analytical rigor and strategic foresight. The journey from identifying a promising candidate to realizing substantial returns is paved with meticulous research, a deep understanding of market dynamics, and disciplined risk management. By focusing on innovative sectors, applying comprehensive valuation techniques, and continuously monitoring your investments, you can navigate the complexities of the 2026 market. The ability to spot overlooked potential and react intelligently to evolving conditions will be the hallmark of successful investors aiming for significant growth.